Contents:

Over the entire 5-year period, the total expense in both cases is $69,350, which represents the total cash outflows. The account entitled Leased Equipment Under Capital Lease is a non-current asset, which is generally shown under the property, plant, and equipment section. Subsequently, Scully Corporation makes yearly payments that are divided between principal and interest, and it also depreciates the equipment. Note that most payments are made monthly, but we assume annual payments here for ease of illustration.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

COMPANY

An operating lease is a lease whose term is short compared to the useful life of the asset or piece of equipment (an airliner, a ship, etc.) being leased. An operating lease is commonly used to acquire equipment on a relatively short-term basis. Thus, for example, an aircraft which has an economic life of 25 years may be leased to an airline for 5 years on an operating lease. The present value of the lease payments equals or exceeds 90% of the total original cost of the equipment.

A lease is a contract under which a property or asset owner allows another party to use an identified property, plant or piece of equipment for a set period of time in exchange for compensation. The two most common types of leases for lessees are operating leases and finance leases. Under the previous standard, ASC 840, there used to be a substantial difference between operating leases and capital leases when it came to accounting for one or the other. The standard required that operating leases only needed to be accounted for on the income statement, and did not need to be recorded on the balance sheet. Accounting for finance leases under ASC 842 is much the same as capital lease accounting under ASC 840.

Often, corporations rent assets such as offices, equipment, and vehicles because renting is more economically viable than purchasing the asset outright. The lease payment obligations occur throughout the term of the lease, whereas a purchase signifies a lump sum, one-time outflow of cash. Understanding how a lease is classified, the key differences from ASC 840 to ASC 842, and its impact to the business will equip your company for success under the new lease accounting standard.

- The lessor likely structured the contract so the lessee will use the specialized equipment for the majority of its useful life or the lease payments equal substantially all of its fair value.

- Finance leases then have imputed interest and are amortized over the life of the lease.

- As a business law attorney serving Coral Springs, Parkland, and Broward County, FL, Matthew has been recognized as “AV” rated, which is the highest rating an attorney can achieve through Martindale’s Peer Review system.

- For lessees governed by ASC 842, leases are deemed either finance or operating based on the criteria outlined below.

- Each will be treated differently on the accounting statements of a business.

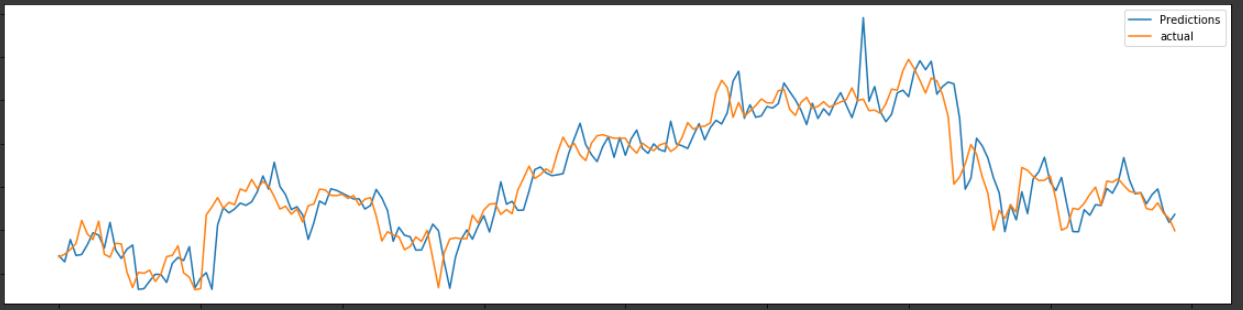

Cash flow from financing activities is affected by debt financing, and the principal repayments made for the debt used to finance the lease.Interest on financing reduces the CFO. The present value of lease payments must be greater than 90% of the asset’s market value. Each year, the sum of the lease Interest expense and the lease payment must equal the annual lease expense, which we confirm at the bottom of our model. The interest expense recorded on the income statement is equal to the difference in the imputed interest expense between the prior and current year. Suppose a company has agreed to borrow an asset for a four-year lease term with an annual rental expense of $100,000 and an implicit interest rate of 3.0%. Because of the terms surrounding the leasing arrangement, the corporation is treated as the owner of the asset for accounting purposes, despite technically “leasing” the asset from the lessor .

Capital Lease vs. Operating Lease Infographics

what does mm mean leases are also not recorded as debt, which means they can be significantly less cumbersome when it comes to contract terms. Additionally, all operating leases that began before the new standard took effect need to be transitioned from the old standard, ASC 840, to the new standard. Under the previous lease accounting standard, ASC 840, there were more differences between these two lease classifications than there are now.

- When assessing lease payments under ASC 842, unlike ASC 840, if a portion of property taxes or insurance is considered a lease payment, then it should also be included for the purposes of the classification test.

- Capital leases and operating leases appear very differently in accounting.

- This is an operating lease and will be recorded on the company’s balance sheet.

- Ownership Transfer → Once the lease term ends, the ownership of the asset is transferred from the lessor to the lessee.

- Ownership is shifted from the lessor to the lessee at the end of the lease term.

On the other side, the loan amount, which is the net present value of all future payments, is included under liabilities. Accounted For A Capital LeaseCapital lease accounting adheres to the principle of substance over form, with assets recorded in the lessee’s books as fixed assets. Over the term of the agreement, depreciation is charged on the asset as usual.

Speak With One of Our Leasing Reps

His major areas of practice include labor and employment https://1investing.in/; business law; corporate, contract and tax law; and estate planning. He is currently admitted to practice law in Georgia, Florida, the District of Columbia and Puerto Rico and currently licensed as a CPA in Florida. This lease document can be very complicated, and it is best to consult with a business lawyeror financial services lawyerwho can help ensure that the agreement is drafted correctly and includes all pertinent information. The lease transfers ownership of the property to the lessee by the end of the lease.

If the terms of the lease agreement meet any of the above-mentioned four criteria, the lease must be accounted for as a capital lease. The distinction between these types of leases is important because a different accounting treatment is required for each. With an operating lease, the lessee doesn’t intend to purchase the asset when the contract ends. The lessor owns the leased asset, and the lessee rents the asset for typically 1 to 5 years. The life of the lease is substantially less than the useful life of the asset.

He opened his own law practice and began working primarily with small business owners until he was introduced into the startup world. Ever since that time, John has worked with hundreds of startups and thousands of entrepreneurs from all different backgrounds in helping them achieve their goals. Having been an entrepreneur his entire life, John understands what it takes to create and maintain a successful business. He enjoys sitting down and working with his clients in figuring out each of their unique challenges. Legal ownership of leased asset transfers from the lessor to the lessee after the end of the lease. The legal ownership of the leased asset transfers from the lessor to the lessee at the end of the lease.

CPI Aerostructures Reports Fourth Quarter and Full Year 2022 Results – GlobeNewswire

CPI Aerostructures Reports Fourth Quarter and Full Year 2022 Results.

Posted: Fri, 14 Apr 2023 20:55:07 GMT [source]

INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more. IFRS mentions a more generic categorization saying that all risks and rewards should not be transferred to the Lessee. Records the underlying asset as its asset, which means that the lessor is treated as a party that happens to be financing an asset that the lessee owns. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Capital Lease Accounting Criteria (U.S. GAAP)

Lease payments are treated as expenses and are deductions on the income statement. Businesses with operating leases don’t want to keep the asset over the long term. Suppose you are leasing a forklift that costs $42,000 and will be used for moving materials in your warehouse. The present value of the lease payment is “substantially equal” to the asset’s fair market value. This is appealing for a large ticket piece of equipment that could break down often, like a car or industrial printer. The business and car company agree to a fixed lease term at the beginning of the contract.

There doesn’t need to be a commitment to purchase the asset at the end of the term but the option is open to you. Many businesses use operating leases for car leases because the cars are used heavily and they are turned over for new models at the end of the lease. First I want to thank you for giving a brief knowledge on Lease, I had little knowledge about the capital lease and operating lease but by going through your article I got a clear explanation on these two.

Thus, capital leases are accounted for essentially as purchases of equipment or other property. A capital lease is a type of lease where the lessor finances just the leased asset and all other ownership rights transfer to the lessee. Operating leases are lease contracts where the terms do not mimic a purchase of the underlying asset.

We can help you learn more about a capital vs. operating lease and determine if one is right for you. We also specialize in offering fast and flexible equipment financing for a wide range of small businesses. There are a number of key differences to note if your business is trying to determine if it wants to use either an operating lease or a capital lease. The differences between capital and operating leases can be confusing but nonetheless it’s important to know the different nuances involved to help you make the right choice for your business. A capital lease is a specific kind of renting contract between a lessor and lessee. The contract allows for the renter to use the asset for a temporary period.

So if our lease has possible extensions built into it that define our potential occupancy to more than 22.5 years we may have a capital lease. So we are told to compute the present value of the minimum lease payments using his incremental borrowing rate. This means that small business owners need to pay attention to the new standards and understand the effects these changes will have on their financial statements and theirability to obtain financing. The following discussion explains the differences between capital and operating leases and considers the effects of the new accounting regulations.

In a world where we are all seeking to stay away from non-compliances, please review your leases and use the following information. A Finance Lease for the same equipment has the same annual payments, but at the end of the term, there is an “ownership transfer” or “bargain purchase” option, so the company has some ownership potential. The bargain purchase option is available in the case of the capital lease. In the operating lease, there is no bargain purchase option available. Risk and returns related to the asset ownership are transferred to the lessee in a capital lease. In an operating lease, the risk and rewards related to the asset ownership remain with the lessor.

The lessee will record the asset as a fixed asset in their general ledger. In this situation, the lessee will record the interest of the lease payment as an expense. The lease term is equal to 75% or more of the asset’s economic life. Lease term is greater than 75% of the equipment’s estimated economic life. We strongly recommend keeping these line items separate from “normal” Depreciation, Interest, and Debt Principal Repayments because Leases are not, in fact, normal Debt – despite the accounting treatment.